I’ve recently been made aware of the FIRE movement and therefore travel hacking. Since this post isn’t about explaining FIRE, Financially Independent Retire Early, I’ll connect you to the ChooseFI podcast so you can learn on your own. Listen to it, do what they say, LOVE IT, and YOU ARE WELCOME! Back to travel hacking!

I’ve recently been made aware of the FIRE movement and therefore travel hacking. Since this post isn’t about explaining FIRE, Financially Independent Retire Early, I’ll connect you to the ChooseFI podcast so you can learn on your own. Listen to it, do what they say, LOVE IT, and YOU ARE WELCOME! Back to travel hacking!

After listening to their travel hacking episode, I’ve been COMPLETELY OBSESSED with this idea! Not just travel hacking for travel sake, but how could I use it to fuel my RVing habits and cut the cost a little bit.

Let me fill you in just a little bit before I pose my queries.

TRAVEL HACKING 101

Here’s a basic rundown of what travel hacking is.

Most credit cards offer some kind of introductory bonus miles. If you purchase X amount of dollars worth of stuff in X amount of time, then you get a bundle of extra points.

Most credit cards offer some kind of introductory bonus miles. If you purchase X amount of dollars worth of stuff in X amount of time, then you get a bundle of extra points.

The guys at ChooseFI like Chase Sapphire Preferred, so let’s use that as an example. If you spend $3,000 in the first 3 months after activating the card, you earn 50,000 points. I don’t know about you, but $3,000 is SUPER easy to spend in 3 months for us!

If not, you can always wait to open the card until you have some major purchase coming up…like a refrigerator or something.

Once you’ve earned these introductory points, you’d move on to another card in what they call the “Chase Gauntlet” until you have gobs and gobs of points allowing you to travel the world for free.

I’m down for that! I mean, I LOVE traveling, and I’m spending the money anyway on my regular living expenses, so I may as well be rewarded for it, right?

THE CAVEAT

Here’s the trick…while my free-spirited right brain says, “yeah, baby…earn those points,” my accountant-like, fun-slaying left brain says, “not gonna do it…wouldn’t be prudent!”

We’ve been Dave Ramsey fans for almost a decade now and it just goes against everything in my mind to even OPEN a credit card, let alone use it RELIGIOUSLY each month for ALL my expenses.

Here’s the caveat: ONLY spend your NORMAL MONTHLY expenses on your card, and you MUST pay the card off…IN FULL…EVERY MONTH! Obviously, you can put other expenses on the card, but ONLY if you can pay it off at the end of the month. Paying interest negates the rewards in the FI community.

UGH!!! Talk about fun-slaying! I know…I know, it’s what responsible adults do, at least that’s what I hear. I’ve found that paying it off each month is actually liberating, though! At least in the sense that I don’t have that balance looming over my head!

TRAVEL HACKING FOR RVS

Now that you know the gist of travel hacking, how can that apply to RVing? No really…I’m asking YOU!!! LOL! I know, I’m supposed to be the expert, right?

Here’s one thing I noticed that I CAN give you as advice for travel hacking for RVs.

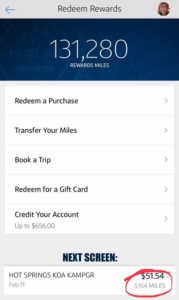

You ARE allowed to “erase” your purchases (at least with a Venture card). From the app, I can click “Redeem a Purchase,” then select the purchase I want to redeem. Travel related purchase show up automatically for redemption.

The only problem I see is that travel hackers usually prefer redeeming points at about a 2-3% exchange rate. “Redeeming” a purchase the way I described happens at 1%, at least with my Venture card.

For instance, our Biloxi RV park was about $350 or so for the week. My card wanted to take 35,000 points to erase that purchase.

WHAT?!

UNACCEPTABLE! I mean, it’s better than paying the $350 for a week, but I have to think if I was a full-time RVer, I’d need 100,000+ points a month or more to camp for free. I just don’t spend that much!

Of course, on my card, I’d get double the points for the purchase in the first place ($350 purchased=700 points), but that would NEVER equal the purchase price of the RV park stay.

I still have to think if you were racking up travel miles using bonus miles, you could knock off quite a few stays at RV parks. This would be a GREAT plus for folks like me who are avid weekend warriors, but you would most likely need hundreds of thousands of points per year at a 1% transfer rate as a full-timer!

If you still do the “Chase Gauntlet” that the ChooseFI guys describe, you’d have roughly 500,000+ points in a 2 year period per married couple. For me as a weekend warrior, that would be MORE than enough for my camping habits.

I just couldn’t go anywhere else. That’s depressing!

SO NOW WHAT?

If you’ve been RVing for any length of time, you know we have other options to save money.

If you’re just getting started RVing, pull up a chair for a sec and let’s talk about it!

Two of our main expenses as RVers are RV parks and gas. Besides redeeming your miles to erase RV park purchase, there are other ways to save some money.

BOONDOCKING

If you want to do the FREE route, you can always boondock just about anywhere. Boondocking is when you camp on either government land, or somewhere else, for free.

The downside to boondocking is that you usually have no water, waste, or electrical hookups. You’re entirely on your own.

There are TONS of posts all over the internet and Pinterest about boondocking, so I won’t divert my attention to that right now. You can also check out Boondockers Welcome for private locations.

STAY LONGER

Another great way to save on RV parks is to stay longer. Often, RV parks will offer a discount for staying longer. We found this out when we went to Gulf State Park. They offered one night free for purchasing 6 days (I think).

Typically, the longer you stay, the larger the discount and monthly rates are the cheapest.

Another great tip for travel hacking RV parks is to find a Workamping job. Workamping is just trading your time for money, basically! That link will take you to their “about us” page…read up…it’s a great option!

GAS SAVINGS

To save on gas, there are several things you can do. You can start by using an app like GasBuddy will help you find the cheapest gas nearby.

GASBUDDY – GASBACK

An added bonus of using GasBuddy is their GasBack feature. You’ll save 10¢ per gallon on your first fill-up (plan this strategically like when you leave for a trip), and 5¢ on each fill-up after that. You can also get GasBack points for shopping at places like Gap, Old Navy, Container Store (yay!), Home Depot (what?!), and Overstock.com.

An added bonus of using GasBuddy is their GasBack feature. You’ll save 10¢ per gallon on your first fill-up (plan this strategically like when you leave for a trip), and 5¢ on each fill-up after that. You can also get GasBack points for shopping at places like Gap, Old Navy, Container Store (yay!), Home Depot (what?!), and Overstock.com.

I haven’t personally tried this, but I bet you could use your grocery store rewards card (or gas station credit card), to scoop up 5-10¢ off per gallon, then use the GasBack card from GasBuddy to save even more…NOW THAT’S TRAVEL HACKING FOR RVS!

USE OTHER REWARDS PROGRAMS

Using other rewards programs are a GREAT way to save on gas!

There’s a local gas station near me (Valero – Big Red) that offers premium gas on Mondays at regular price. That’s already a savings of 10-20¢ per gallon, then if you’d use GasBuddy’s GasBack card, you’d save another 5¢ per gallon. NOW we’re talkin’!

Check out your local area for which gas station offers the best gas rewards.

You can also use your Costco or Sam’s Club memberships to save on gas. I wouldn’t intentionally buy a membership to save on gas, but if you already have one, this would be a great way to make use of your membership.

As far mentioned above, staying in one location longer also saves on gas. If you are in a larger city, consider using public transportation while in that town if your normal vehicle is a gas guzzler.

DID I MISS ANYTHING?

How ’bout it…did I? Do you have a favorite travel hacking tip for the masses that I may have missed? Please share your tips below!

If you enjoyed this post, please share it on Pinterest or hit one of the share buttons for your favorite social media!

Leave a Reply